To comply with their archiving obligations, many organisations still file important documents – receipts, invoices, business records, etc. – and store them in archive rooms. – and store them in archive rooms.

However, due to increasing digitisation, fewer and fewer physical documents are being created, while the number of documents in digital form is steadily increasing.

Duties and regulations are also continuously being adapted to an increasingly digitalised and networked world.

This is precisely why electronic archiving solutions are becoming increasingly important.

They help organisations to comply with relevant legal requirements, especially with regard to audit compliance.

Audit-proof archiving is imperative, as it enables you to disclose important documents, records, receipts and emails without much effort in the event of unannounced tax audits or the annual financial statement.

If you are not able to do this, or if there is a breach, you will have to expect heavy fines or, in the worst case, even imprisonment.

In this guide, we will go into everything you need to know about audit-proof archiving so that you are always prepared for a tax or company audit.

Table of Contents

Definition: Audit-proof archiving

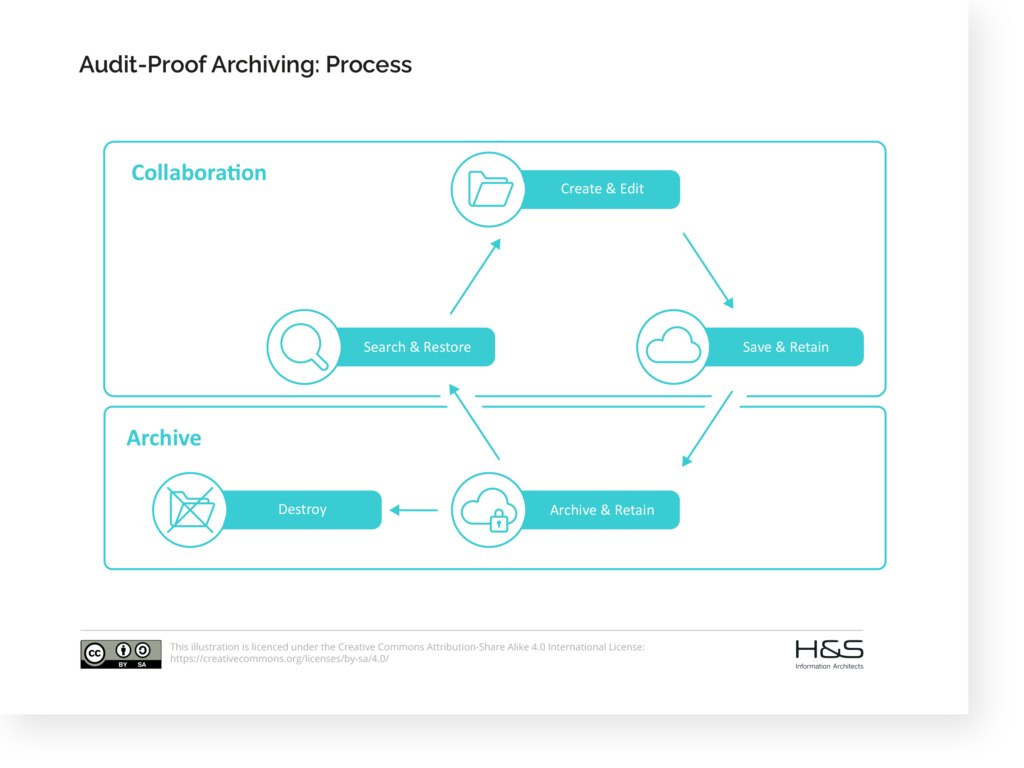

In simple terms, audit-proof archiving is the digital storage of documents, records, receipts and emails that must be kept in accordance with legal as well as tax and commercial regulations.

The form and duration of audit-proof archiving can be found in the legal obligations and regulations (see next section).

However, audit-proof archiving does not only refer to the factor “availability”, but also to the factors “inalterability”, “traceability” and “completeness”.

It is important to understand that these factors refer to all changes to your documents, records, receipts and emails.

The aim is to protect them from falsification.

In practice, this means for you that you must meticulously record every business transaction – such as changes, overwrites or deletions – and store them in your electronic archive in a proper and traceable manner.

In addition, you should make sure that all documents, records, receipts and e-mails can be made readable at any time in terms of content and images.

This is the only way to ensure complete traceability of all business transactions.

However, you need not worry about having to do all this manually – this is where an archiving software supports you (see “Audit-proof archiving: archiving software as the linchpin”).

Some archiving solutions are even equipped with a long-term archives that allows you to store your documents, records, receipts and emails effortlessly, even for months or years.

Audit-proof archiving: legal basis in the DACH region

The storage obligations that you as an organisation must be aware of and fulfil are extensive and complex.

In addition, the legal requirements in the DACH region differ greatly in some cases.

To give you a good overview, we have compiled the following information for you.

Audit-proof archiving: Federal Republic of Germany

Principles for the proper keeping and storage of books, records and documents in electronic form as well as for data access, described in the German Commercial Code (§ 239, § 157 HGB) and the German Fiscal Code (§ 146, § 147 AO), or GoBD (formerly GDPdU and the GoBS).

Audit-proof archiving: Austria

Retention obligation according to Federal Fiscal Code § 132 (BAO), Value Added Tax Act § 11 para. 2, § 18 para. 10 (UStG 1994) and Business Code § 190, § 212 (UGB).

Audit-proof archiving: Switzerland

Obligation to keep records in accordance with accounting law 957 – 958f OR, 961 OR, 962 OR, 963 OR and Business Records Ordinance (GeBüV, SR 221431) as well as Business Records Ordinance Art. 9 (GeBüV; Permissible alterable and unalterable information carriers).

Audit-proof archiving: analogue & digital

Legal obligations & regulations

In principle, you must store everything that is relevant for tax purposes.

This applies to both analogue archiving (physical documents, records and receipts) and digital archiving (e-mails incl. attached files).

In this context, several aspects determine the type and duration of storage.

This means that several obligations and regulations may have to be complied with in order to ensure adequate, audit-proof archiving.

However, the obligations and regulations in question do not apply alternatively, but cumulatively.

To ensure that you comply with the correct duties and regulations, you should always consider the following aspects:

- Legal form of your organisation

- Areas of activity

- Content of documents, records, receipts and emails

E-mails should not be filed and stored in the e-mail system itself, but in special archiving software.

This way you can always prove that the relevant data cannot be changed.

If an email has no relevant content, you do not have to archive it or keep it for data access.

However, it happens time and again that e-mails that do not appear to be relevant nevertheless are.

Therefore, if in doubt, it is better to keep too many e-mails than too few.

Individual duties & regulations

Duties and regulations can also be contractually agreed.

Indeed, contractual freedom allows archiving obligations to be agreed individually in different ways.

This is particularly useful if there are no clear and direct statutory duties and regulations for a particular case.

The content and period of the archiving obligation can therefore be completely independent of legal obligations and regulations.

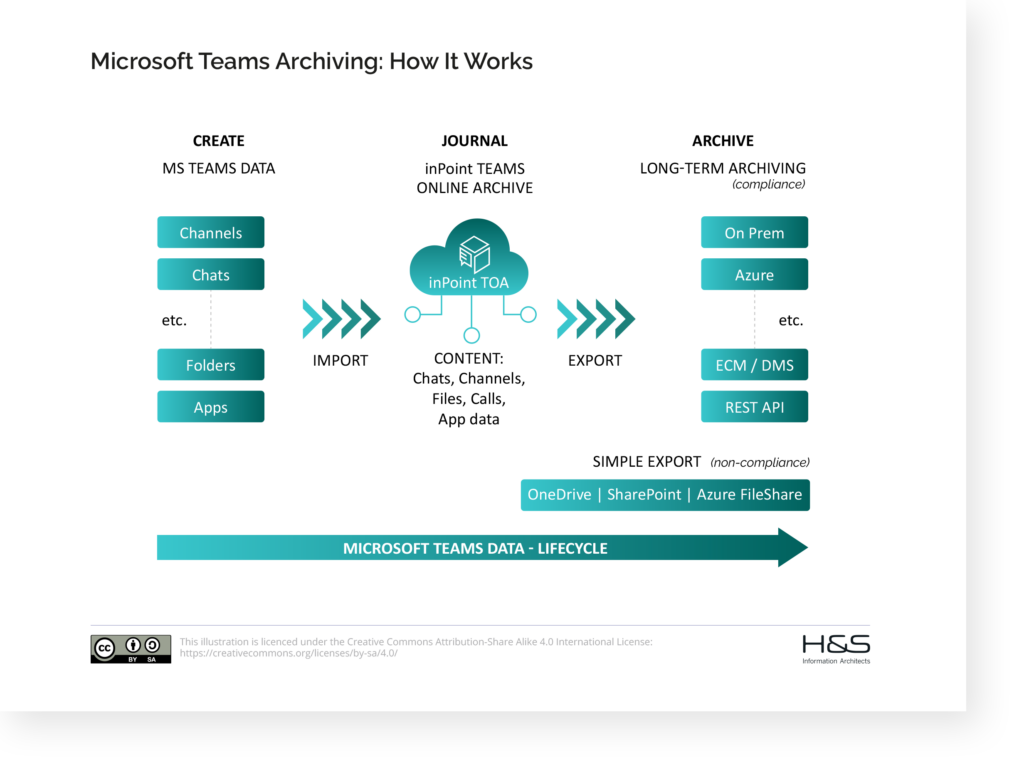

For example, two companies can agree that the entire chat history from Microsoft Teams is to be retained for a period X, such as the duration of a specific project.

Focus topic: Microsoft Teams Archiving

Audit-proof archiving: archiving software as the linchpin

For audit-proof archiving, there is a wide range of archiving software available to you as an organisation.

To find and use the right archiving software for your organisation, you need to identify your individual requirements as precisely as possible in advance.

Especially if you want to archive documents, records, receipts and emails, you should ensure proper filing and archiving.

Archiving software supports you in this – in accordance with the principles of proper accounting.

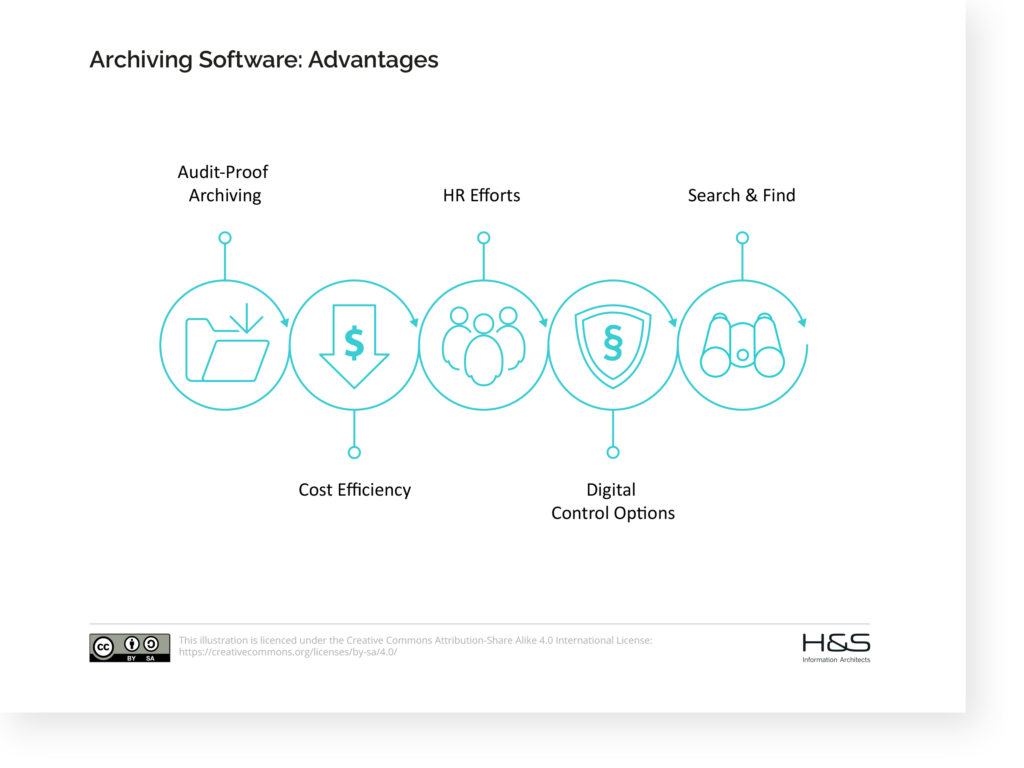

Archiving software: advantages

There are other important advantages to choosing archiving software:

Personnel effort

Once archiving software is part of your daily processes, you need less personnel for proper and audit-proof archiving.

Search & find

In the event of queries, archiving software eliminates the need to search and find documents, records, receipts and emails, as they can be accessed conveniently directly on your PC or smartphone.

Cost efficiency

If you use archiving software, you can minimise physical archiving if necessary, which saves costs for paper, printers and filing.

Digital control options

Archiving software also allows you to make data easily available to authorities, for example when digital control options are possible. In short: with archiving software, you are guaranteed to be prepared for a tax or company audit.

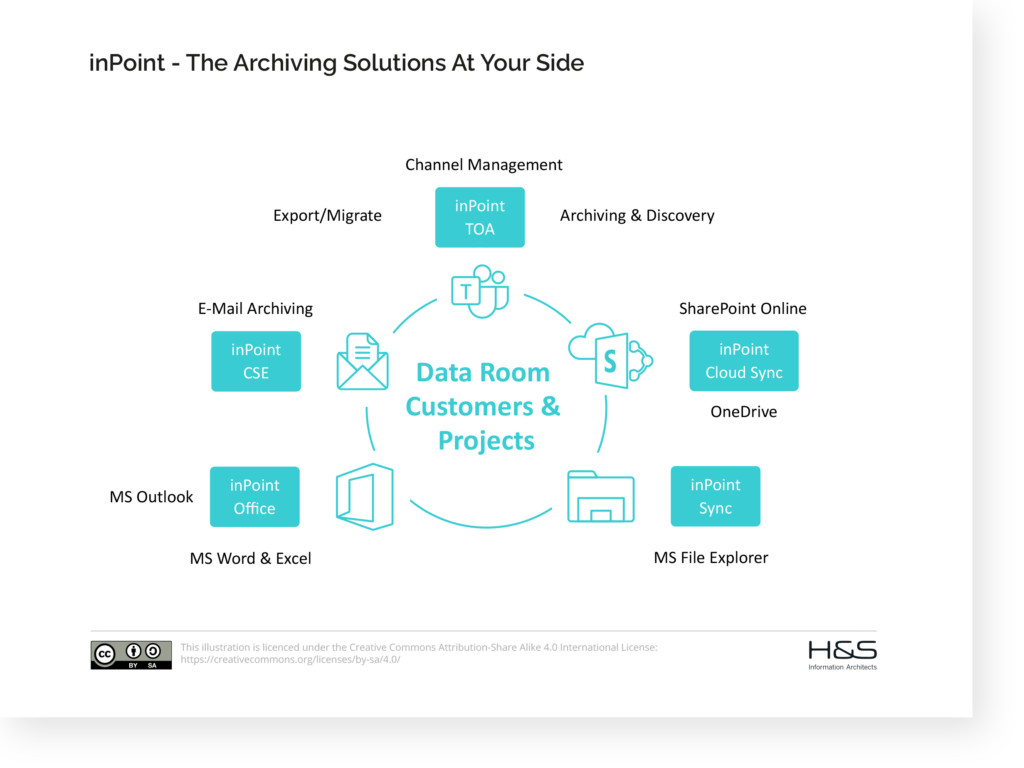

inPoint –The archiving solutions at your side

With the inPoint Suite, we have created a comprehensive solution portfolio that supports you with all your archiving requirements.

inPoint Suite:

Conclusion

Audit-proof archiving is imperative because it enables you to disclose important documents, records, receipts and e-mails without great effort in the event of unannounced tax audits or the annual financial statement.

Put simply, audit-proof archiving is the digital storage of documents, records, receipts and e-mails that must be kept in accordance with legal as well as tax and commercial regulations.

If you are not in a position to do this, or if there is a breach, you must expect heavy fines or, in the worst case, even imprisonment.

The storage obligations that you as an organisation must know and fulfil are extensive and complex.

In addition, the legal requirements in the DACH region differ greatly in some cases.

Here, an archiving software in particular supports you.

With the inPoint Suite, we have created a comprehensive solution portfolio that supports you with all your archiving requirements.

Have we sparked your interest in an archiving software?

Please feel free to arrange a first consultation with us!

Share article

Stephan Gehling

I have been with H&S Heilig und Schubert InformationsManagement GmbH since 2007 and am responsible for the Business Communication Solutions and M365 division. With over 25 years of IT and project experience, I act as a specialist in the area of archiving solutions and Microsoft 365 Cloud products.

As an IT specialist with a Master of Business Administration and Microsoft Certified IT Professional (MCITP), I was already responsible for solution sales in the IP Networking and Security environment at Siemens AG, among others. As part of my BITKOM activities, I am involved in the Business Communication Solutions working group. It gives me great pleasure to explore new technologies and paths with partners and customers and to establish them successfully.

Consultation

Please use this form to book your free consultation.